Today, we will talk about a company whose name every girl has heard: 💄Nykaa. The first crush of makeup, the favorite brand of skincare, and the trusted platform for online shopping. Nykaa Stock Ki Kahani Startup Se Stock Market Tak

When we think of beauty in India, we think of Nykaa. But do you know that behind this glamorous name is hidden a solid business journey? When we talk of bold women in business, we name Falguni Nayar. From a modest online store to a billion-dollar publicly listed company, and after the recent stock market fall, everyone is asking – “Is Nykaa still a good investment? But with rising competition and market volatility, the question arises: Is Nykaa still a good business today?

Let’s explore.

Table of Contents

👩💼 The Woman Behind the Brand: Falguni Nayar Ek Bank Se Beauty Bazaar Tak

Let’s first talk about Falguni Nayar, the founder of Nykaa. A working woman, a mother, and a daring dreamer. She left her comfort zone at the age of 50. he took a bold leap, leaving behind a high-profile career to start something of her own quit her high-profile job at Kotak Bank and started Nykaa in 2012. Falguni Nayar was already a powerhouse in the finance world before she became a beauty entrepreneur. A graduate of IIM Ahmedabad, she spent nearly two decades at Kotak Mahindra Bank. She saw a gap in India’s fragmented beauty market: a lack of trusted, curated, and accessible beauty products online.

🛍️ Nykaa’s Business Model:

Nykaa stocked products in its warehouses, so there was no chance of fake products.

Omnichannel approach: Online was there, but offline stores were also opened. (Nykaa Luxe, Nykaa On Trend).

Omnichannel approach: Online was there, but offline stores were also opened.

- Content + Commerce: They created awareness through beauty blogs, YouTube tutorials, and influencers.

This was the reason why Nykaa became an emotion and not just an app for women.

📈 nfluencer collaborations—created a loyal community. Tutorials, reviews, and expert advice turned Nykaa into more than a store; it became a beauty destination.

💰 The IPO (Nykaa Stock) That Made History

In November 2021, it launched its IPO and was oversubscribed 81.78 times. On listing day, its shares surged nearly 80%, giving it a market cap of over ₹1 lakh crore (~$14 billion). Falguni Nayar became India’s richest self-made woman billionaire.

💡 Is Nykaa Still a Good Business?

Let’s break it down:

| Factor | Status |

|---|---|

| Brand Trust | Strong – Nykaa is still synonymous with beauty in India |

| Customer Base | Over 1 crore unique transacting customers |

| Revenue Growth | Consistent YoY growth, especially in fashion and private labels |

| Profitability | Under pressure, but improving with scale |

| Innovation | Strong focus on tech (AR try-ons, personalization) and content |

| Leadership | Falguni Nayar’s vision and credibility remain unmatched |

🌍 What Nykaa Means?

Nykaa is not only a successful business, but it’s a symbol feelings of what women can achieve when they lead with clarity, courage, and customer focus. Falguni Nayar didn’t just build a company; she built a movement.

For women looking to start their own ventures, Nykaa offers powerful lessons:

- It’s never too late to start (Falguni was 50!)

- Deep industry knowledge is a superpower

- Customer trust is your biggest asset

- Content and community can drive commerce

- Build for the long term, not just the next quarter

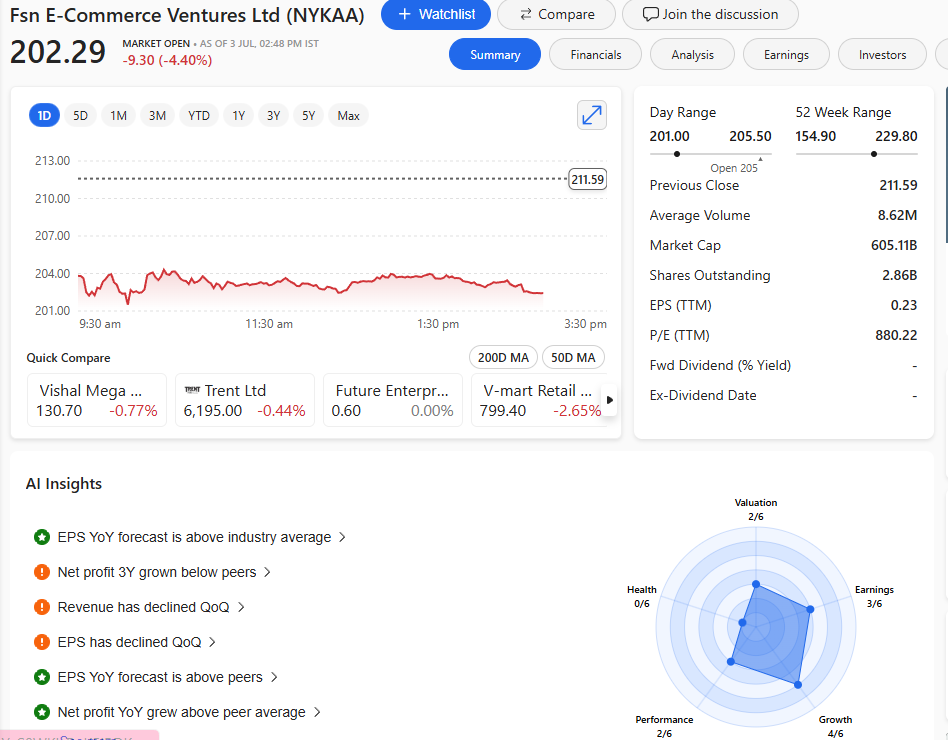

Why Nykaa’s Stock Dropped Over 4% Today’s - Today, Nykaa’s stock (FSN E-Commerce Ventures Ltd) is down 4% during early trading. Nykaa stock ke down hone ka reason block deal hai .

- Well, the main reason is a big block deal. Two early investors — Harindarpal Singh Banga and Indra Banga — decided to sell around 6 crore shares, which is roughly 2.1% to 2.3% of Nykaa’s total equity. The total deal value? A whopping ₹1,200 crore!

👉 Shares Sold at a Discount: These shares are being offloaded at around ₹200 each — that’s about a 5.5% discount compared to yesterday’s closing price of ₹211.59. This kind of discount usually puts pressure on the stock

👉 Market Sentiment Impact: When early investors book profits like this, it often signals to the market that they may feel the stock is fully valued for now, leading to some cautious selling by others. - Even though Nykaa has recently shown signs of a recovery and big investors still have faith, this large-scale selloff has pulled the share price down today. Also, analysts are pointing out that Nykaa still trades at a high valuation (P/E ratio), making it more sensitive to moves like these.

🧠 Final Thoughts

WealthForHer ke points of view se

“Beauty sirf skin-deep nahi hoti. Business bhi surface ke peeche bohot kuch hota hai.”

Nykaa Stock ne hume sikhaya – ki ek woman-led business bhi unicorn ban sakta hai. Lekin har unicorn Nykaa stock market mein hamesha shine kare, yeh zaruri nahi.

Agar aap bhi investment journey start kar rahi hain:

- Company ki story samjho, sirf price mat dekho.

- News sun kar ke invest mat karo.

- SIP kro, research kro, aur patience rakho.

At WealthForHer.com, hum aisi stories ko celebrate karte hain — kyunki yeh hume yaad dilati hain: “Wealth sirf paisa nahi hota — yeh hota hai freedom, impact aur inspiration ka source.”

Nykaa ne hume yeh sab diya — as consumers, as investors, and most importantly — as women.