💰 Why is investing important for every woman?

Hello, my strong and smart sister 💕 Have you ever thought… we care about everything – home, family, budget… but have we ever cared so much about our future?

Investment for women is not just a necessity for every woman in 2025; it is an act of self-love. How big money can be made from small beginnings, this blog will touch your heart. 😌 Today I want to talk to you about a simple thing – “Investment”. No, it’s not boring, and it’s not just about numbers. These are the things that give us freedom, peace, and confidence in our lives. And I know, you also think like me – “I don’t have much money, what will I invest?

But trust me, investing is more a matter of “determination and thinking” than money.

🌱 Small beginning, big flight

I started investing in 2024 with the amount of ₹500 in a SIP (Systematic Investment Plan).

If you don’t buy one dress every month, this money is saved, isn’t it? And this money becomes a magic tree for you in the future – in the form of compound interest.

Every month a small amount makes you financially independent.

Who likes to be dependent on someone? I definitely don’t.

And I know, you also have to make your future strong.

Table of Contents

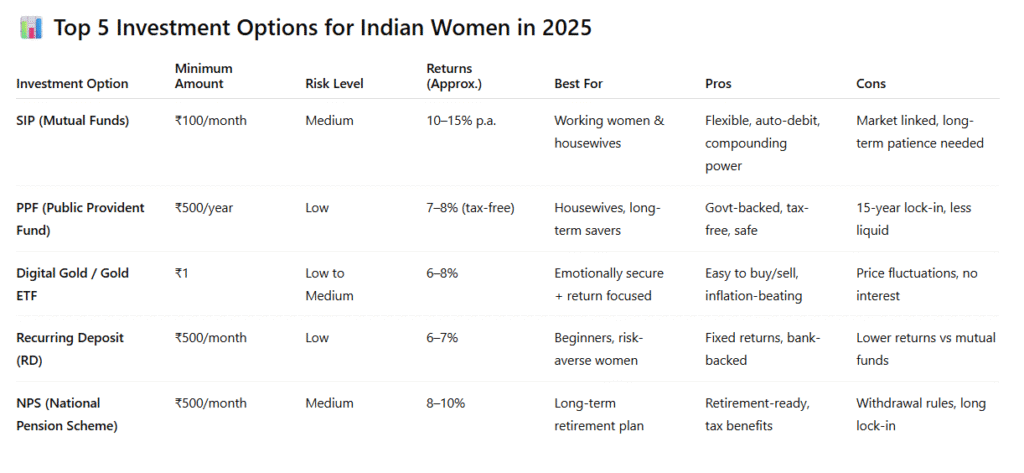

📊 Top 5 Investment for Women in 2025

SIP (Mutual Funds) – Start with ₹100-₹500 per month.

Gold Savings (Digital Gold/Gold ETFs) – Safe and emotionally connected too.

PPF (Public Provident Fund) – Perfect for Long-term and also tax-free.

FD (Fixed Deposit) – Safe Return, Zero Tension

| NPS (National Pension Scheme)-Perfect for a Long-term retirement plan and also offers tax benefits |

💸 Systematic Investment Plan (SIP) – A Smart and Easy Method

My dear sister 💕SIP (Systematic Investment Plan) – is such a simple and powerful tool that makes money for your or your daughter’s future without any tension. Whether you are a housewife, student, or working woman, you can start with Rs. 100 per month!

Yes, just save one chocolate and you become an investor. 😄

🌱 Why is SIP best for women?

🔹 Small amount, big thinking

🔹 Discipline comes to you

🔹 The Magic of Rupee Cost Averaging:

🔹 Money Grows by Compounding:

Just like you water a plant daily, SIP strengthens your future.

🪙 Gold ETF – Smart Gold Investment for Women’s Future

Listen, my dear sister 💛If you want to buy gold for yourself for the future, then don’t just think of jewelry or coins.

Today’s smart and safe option is: Gold ETF.

✨ What is Gold ETF?

This is a mutual fund in which one unit = 1 gram of gold. But not physical gold – it trades like shares on the stock exchange. You can buy it from your phone – easy, tension-free!

💡 What is its benefit?

🔐 No tension of the locker, no fear of theft:

📈 Buy or sell at Market Price

💰 Low Investment, High Diversification

🌟 Best for Long-Term

🏦 PPF (Public Provident Fund) – Safe & Tax-Free

PPF is a government savings scheme that is a long-term investment for women, with a 15-year lock-in period and tax-free maturity. This plan is ideal for education investment due to its consistent growth, tax benefits, and compounding nature.

🟢 100% Safe & Secure

📈 Compounding Magic

📉 Tax-Free Returns

👧 Best investment for women’s future

🏦 Fixed Deposit (FD) – Safe Return, Zero Tension

FD is a scheme where you deposit money once and get fixed interest on it, without any market fluctuations. For those who do not want to take risks and want secure, fixed income, an FD is a perfect option.

💡 Main Benefits of FD

💰 Guaranteed Returns

📉 Market Risk = Zero

🕒 Flexible Duration

👧 Perfect Investment for Women Milestones

🏦 Extra Interest Senior Citizens

🧾 National Savings Certificate (NSC) – Safe Investment for Women Future

If you are looking for a plan which is safe, has fixed returns and comes with government guarantee, then NSC – National Savings Certificate is a very reliable and tension-free option – especially if you are planning for your daughter’s future.

📌 Main Features of NSC – In Simple Words

🕔 Tenure & Maturity

📈 Interest Rate

💰 Investment Amount

🧾 Tax Benefit

🔐 Transfer & Safety

👩💼 We Deserve Financial Freedom

Every woman should not only earn, but also grow. If money is kept in savings, then inflation will be used up…

But if you invest, then the same money will fulfil your dreams. 💖

✨ In the end…

Don’t think that you are late. The day you start becomes your best day. For yourself, living is not selfish – it is self-respectful. So my sister, make a small investment plan today itself.

I am with you at every step. 🤝💬

Also read: Best Money Saving Habits For Women Of 2025

Gold mein invest karna safe hai ya nahi?

Haan, lekin Digital Gold ya Gold ETF zyada smart option hai — locker ka tension nahi, aur aap phone se easily buy/sell kar sakti ho.

Plus, inflation ke against protect karta hai.

Kya ₹500 se bhi investment possible hai?

Bilkul! Aaj ke time mein ₹100–₹500 se bhi SIP, RD, aur PPF shuru ho sakta hai.

Investment ke liye bada paisa nahi — consistency zaruri hai.